Fintiba Plus:

Customised package of Blocked Account and Health Insurance for your stay in Germany

✔ Free Travel Health Insurance worth € 95.001

Preparing your visa application has never been easier

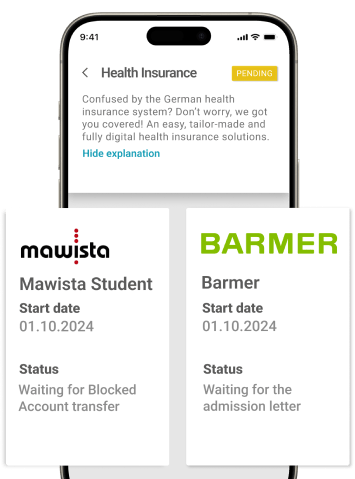

Get your blocked account together with the required health insurance within one solution covering everything from your visa appointment until the enrolment at your university – everything fully digital and app-based. Save time and let us take care of what you need for your stay in Germany.

Accepted

by the German authorities worldwide

Recommended

by major German universities

Trusted

by customers from >190 countries

The Fintiba Plus package covers all eventualities

Depending on the purpose of your stay, the duration of your previous studies and your age, your package will include some or all of the following components – but always only what you need:

Blocked Account (Financial Proof)

Health Insurance for Visa (Free Travel Health Insurance)

Health Insurance for Language Course / Studienkolleg

Health Insurance for University

Everything will be individualised to your personal situation

By just providing us with a few details about your person and your plans in Germany we evaluate which health insurance your tailored package needs to include

Visa

Blocked Account and Free Travel Health Insurance to prove your financial means and insurance coverage for your visa

Preparation Course

(If applicable) Private Health Insurance to cover the insurance gap up to your official university enrolment

University

Public Health Insurance will become effective as soon as you are enrolled at a German university

Advantages of the Fintiba Plus package

Free Travel Health Insurance for your visa application worth € 95.001

NEW! Instant blocking confirmation with a credit card payment via Fintiba Transfer

Annual opportunity to apply for the Fintiba Scholarship

Complying with all authority requirements2

Unlimited Private and/or Public Health Insurance

Step by step guidance through the process in your Fintiba app

Access to free webinars and video on-demand courses from the Fintiba Academy

Dedicated customer care team supporting you through the process

All digital documents for your enrolment already available prior to arrival in Germany

Blocked Account

Fast

Blocked Account opening in less than 10 minutes3

Secure

Blocked Account opening in your name to guarantee security and facilitate international money transfers

Fair

Saving on monthly fees in case the visa is rejected

Efficient

German Euro account (no problems with conversion rates or at local authorities)

Guaranteed

Highest security of the money due to the German deposit protection fund

Easy

No registration letter (Anmeldung) needed to ensure fast money access in Germany

.jpg)

The fastest way to your blocking confirmation, now even faster! Get your blocking confirmation instantly after a credit card payment via Fintiba Transfer!

Save time & money on your international transfer and pay in your money with Fintiba Transfer. Enjoy zero transfer fees, great currency exchange rates as well as a fast & transparent process.

Travel and Private Health Insurance

Travel Health Insurance

- Free of charge within the Fintiba Plus package1

- In accordance with all authority requirements2

- Unlimited insurance coverage (more than € 30,000.00 are covered)

- Valid for the agreed period within 12 months from the applied start of insurance – multiple entry and exit is possible

- Coverage complies with the requirements of the European Parliament and Council

- Including travel liability insurance

Private Health Insurance

- Valid for 60 months (automated cancellation in case you switch to governmental health insurance)

- The insured services are paid 100% by the insurer (with the exception of maximum limits for special services such as glasses or dental prostheses)

- Insured region: Germany and the states of the EU (+ Switzerland, Liechtenstein, Norway and Iceland)

- Free choice between the Classic and Comfort tariff

- Including an insurance card in the Comfort tariff, to identify yourself when seeing a doctor

A German Health Insurance is a prerequisite for your stay in Germany

Every person who wants to study or work in the Federal Republic of Germany is required to prove sufficient financial means and health insurance. Otherwise, a visa will not be granted and there will be no enrolment at a German university.

Public Health Insurance

Top Health Insurance

For students according to Focus Money Magazine, distinguished for its TOP service and 100% performance

Doctor Finder Service

An online service designed for internationals, facilitating the search for doctors who speak your native language and allowing you to book appointments with specialist

Cost Coverage

Barmer covers various medical services and preventive check-ups are covered (e.g. 100% coverage of the travel vaccinations)

English Service Hotline

English Service Hotline is accessible Mo.-Fr. from 7.00 to 20.00, regardless of your location worldwide

Barmer Teledoktor

Qualified doctors are available daily from 7.00 to 22.00 and on weekends from 8.00 to 20.00 to provide BARMER members with free medical advice via telephone or video chat

Campus Coach

Supports students with meditation and fitness exercises, but also healthy recipe ideas and mental health advice

General Information on German Health Insurance

The German Health Insurance System

To prevent that you must pay the costs of medical care or medications privately in case of illness or an accident, in Germany it is mandatory to have health insurance – especially for international students who are otherwise not allowed to enrol at a university.

The health insurance system in Germany is one of the most effective worldwide. The system is based on two types of health insurances – the statutory (or governmental) health insurance and private health insurance. Whereas the governmental health insurance is accessible for everyone, certain conditions apply for private health insurance.

Since citizens from outside of the EU member states are not able to remain insured in their home country’s health insurance, they need to cover themselves with German health insurance.

Public Health Insurance

In general, the public health insurance contribution is based on the income of the policy holder. However, for (international) students, all public health insurance providers in Germany must offer an affordable tariff for students up to 30 years of age or until the end of their 14th semester of studies.

The public insurance contribution for international students is the same for all health insurance companies. On top of that, there is an individual additional contribution to the respective health insurance company.

Since the normal tariff of public health insurance providers is significantly higher than the student tariff, it may, therefore, be a better solution for someone who is older than 30 years or has already completed the 14th subject-related semester to take out private health insurance.

Within our Fintiba Plus package, we will automatically evaluate which option would suit you best.

Private Health Insurance

In general, there is a certain group of people who are often privately insured. Employees whose gross income is above the income threshold for compulsory insurance, public servants, self-employed persons and freelancers. In contrast to the governmental health insurance, the contributions are not calculated by the income but depending on the state of health, age and scope of benefits. Therefore, you will have to give detailed information on your state of health so that the company can individually adapt the insurance coverage and the tariff. For international guests in Germany, the private health insurance companies often offer special rates which are adapted to the needs and length of the stay.

However, as soon as you apply for private health insurance you will still need an exemption from the obligatory statutory health insurance when enrolling at university. After exemption, you will not be able to switch back to statutory health insurance.

It is important to notice that all treatment costs must be paid in advance by the policy holder. Afterwards, the private health insurance company will reimburse the costs upon submission of an invoice (cost reimbursement principle).

The insurance cover expires as soon as the policy holder returns to his or her home country.

Why do I need a Public Health Insurance for my enrolment?

According to German law § 5 paragraph 1 Nr. 9 Sentence 1 SGB V, all students are required to obtain health insurance with a public health insurance company. Consequently, you can only enrol when you have valid health insurance. An incoming/travel insurance cannot be accepted for the enrolment.

In case you can provide equivalent health insurance in all aspects of coverage from your home country that is valid here in Germany, you would still need to be exempt from the public health insurance before your enrolment at a German university.

Please be aware that an exemption from statutory health insurance in Germany will be a final decision that cannot be reversed for the whole duration of your stay.

Important Notice for International Students

Students who are attending a preparatory language course or for example a “Studienkolleg” also need health insurance. Since in their case, they are not yet enrolled in university and therefore not eligible for the statutory health insurance, private health insurance needs to be taken out.

Attention: International students who are privately insured in Germany but who are not yet 30 years old or have not yet completed their 14th subject-related-semester often need a certificate of exemption from the statutory health insurance for enrolment in case they want to stay privately insured. A change to statutory health insurance within the study stay is no longer possible after that.

Within the Fintiba Plus package, we will change your insurance coverage from private to governmental automatically in case you are eligible for it. You don’t need to worry about anything!

What is a Travel Insurance?

Besides public (statutory) and private health insurance, Travel Insurance is a type of health insurance for incoming guests (students and many others) for their visit to Germany. Travel Insurance is important if you arrive in Germany prior to your actual enrolment date. This is because your statutory health insurance only protects you in case of illness from the date of your enrolment onwards. Meaning you will not be insured for the days or weeks in between your arrival date and the actual start of studies. Travel Insurance is a cheap and effective way to protect you against that risk.

More Details on the Fintiba Plus Package

Details regarding the Fintiba Blocked Account

The Fintiba Plus package always includes a “Blocked Account” to prove your sufficient financial means as well as “Travel Health Insurance”. These two aspects are a prerequisite to receiving a visa for Germany.

The Blocked Account is officially approved by the German Federal Foreign Office and therefore recognised worldwide. Fintiba is the most experienced blocked account provider and market leader for digital blocked accounts since January 2017. With customers from over 190 countries, we have excellent knowledge of all country-specific eventualities and can, therefore, guarantee the best customer support.

The Blocked Account can be opened completely online and within only a few minutes. You will get access to your personal Fintiba account where you can manage the required actions for the account opening. As soon as the account is successfully opened, you will be able to transfer money to the blocked account opened in your own name. Immediately after the money has arrived, the blocking confirmation for your visa appointment will be issued automatically.

For more information on the blocked account click here.

What does the Travel Insurance cover?

The Fintiba Plus package includes the “MAWISTA Visum” as travel insurance which is issued for a duration of 183 days. The health insurance is provided via our service partner MAWISTA and the coverage complies with the requirements of the council regulation (EC) no. 810/2009 of the European Parliament and Council as of 13.07.2009 and is unlimited. The health insurance protects you from the high costs of illness or accident during your stay.

Below, you can find the most important benefits of the travel health insurance which are included in the Fintiba Plus package:

✔ Outpatient treatment

✔ Inpatient treatment

✔ Medicines and dressings

✔ Pain-killing dental treatment and repairs of dentures and provisional measures up to € 250.00

✔ Transport costs to the nearest suitable hospital

✔ Funeral or repatriation costs (max. € 25,000.00)

✔ Repatriation to home country *

✔ Treatment of existing diseases until the insured person can be transported again after the insurance protection has expired, limited to 45 days

✔ Travel liability insurance

What does the Private Health Insurance cover?

Depending on your needs, the Fintiba Plus package may include the “MAWISTA Student” as private health insurance.

Below, you can find the most important benefits of the private health insurance which is included into the Fintiba Plus package:

✔ Outpatient treatment

✔ Inpatient treatment

✔ Medicines and dressings

✔ Aids-related to the accident (not including sight aids and max. € 250.00)

✔ Medical treatment (e.g. massage), up to 8 per insurance year

✔ Analgesic dental treatments, denture repairs and temporary solutions (max. € 500.00)

✔ Transport costs to the nearest suitable hospital

✔ Pregnancy, childbirth and their implications

✔ Funeral or repatriation costs (max. € 25,000.00)

✔ Repatriation to home country

What does the Public Health Insurance cover?

BARMER offers comprehensive health coverage, including necessary treatments, medications, and dental care. Members benefit from free preventive examinations and screenings, including skin checks and the “Check-up” for early disease detection.

They also provide free choice of doctors and hospitals, access to multilingual doctors through the BARMER Doctor Finder, and the BARMER Teledoktor app for digital consultations. Additionally, BARMER reimburses travel vaccination costs.

Digital services like CyberHealth offer free health and fitness videos for members to train at home.

Information on the free Travel Insurance

The Fintiba Plus package includes a free Travel Health Insurance worth € 95.00. This also applies to customers whose package does not include governmental health insurance!

Students who are eligible for the public health insurance will be switched to BARMER from the day of their official enrolment. Students who have (interim) private health insurance included in the package will be switched over to MAWISTA Student after their arrival in Germany in order to align with the requirements for the residence permit.

Please note that the respective insurance conditions always apply.

What happens when the visa is rejected?

In case your visa is rejected or in case you need to cancel your duration earlier than expected after you arrive in Germany, it is always possible to completely close your Fintiba Plus package. Depending on your specific situation, one of the following processes will apply:

- In case you are in your home country and your visa was rejected/you withdrew your visa application, or you did not even apply but want to cancel your trip to Germany, we will need an official confirmation from the German embassy or consulate which allows us to close your account and your Fintiba Plus package respectively.

Note: In case of a visa denial, the visa rejection letter is a valid document to close your account. Afterwards, the reversal transfer will be executed to the original account where the money came from. Please note that the process can take 3-4 weeks until the money is in the account.

- In case you are already in Germany and want to cancel your stay for any reason, we will need an official document from the Foreigners Office (Ausländerbehörde) which allows us to close your blocked account. Afterwards, we will transfer the money back to the account it came from.

Note: If you are already legitimated, we will be able to transfer the money to your German current account too, depending on your instructions.

Upon successful closure of the account, both your Blocked Account and your Health Insurance products, depending on your package type, will be cancelled for you. Please be advised that the following documents CANNOT be accepted to close the Fintiba Plus package: de-registration letter (Abmeldebestätigung), border-crossing certificates (Grenzübertrittsbescheinigung), stamp in your passport when you re-enter your home country, declaration of commitment or self-created documents.

For more questions regarding the Fintiba Plus package, please check our Help Center.

What distinguishes BARMER from other health insurance providers?

In the following, you can find the differences between BARMER and other statutory health insurers.

BARMER covers many additional services not covered by other health insurance companies, such as:

- 100% coverage of the travel vaccinations

- free preventive examinations and screenings, such as our free comprehensive “Check-up” for the early detection of health risks, disease and exposure.

- free comprehensive Skin Check – available to BARMER members every two years up to the age of 34.

- with BARMER Doctor Finder you can find a doctor who speaks your preferred language

- digital services like CyberHealth offers free health and fitness videos for members to train at home

Overview of the initial and monthly fees of the package

-

Your Fintiba Service Initial Fee Monthly Fee Blocked Account € 89.00 € 4.90 Travel Health Insurance FREE Private Health Insurance (if applicable) € 25.004 Public Health Insurance € 128,385

1 With the Free Travel Health Insurance in the Fintiba Plus package, you can save up to € 95.00. Please note that your right to free travel health insurance will expire if you do not activate either the private or statutory health insurance included in the package.

2 We will issue an insurance confirmation which is valid for 183 days.

3 With our new OCR technology, your passport will be verified within minutes and you are ready to transfer your money right away. Please note that Russia (RU), Ukraine (UA), Cuba (CU), Iran (IR), Syria (SY), North Korea (KP) and the region Crimea are at the moment not eligible for this process. Alternative passport verification options are available for those countries which as well ensure a fast blocked account opening.

4 The MAWISTA Student Classic tariff costs € 25.00 per month for people up to 29 years of age. For people from 30 years up to 39 years of age the costs increase to € 38.00 per month. The MAWISTA Student Comfort tariff costs € 60.00 per month for people up to 29 years of age. For people from 30 years up to 39 years of age the costs increase to € 89.00 per month.

5 The payment of the fees starts after enrolling at the university. BARMER charges € 128,38 for persons under 23 years of age and € 133,25 for childless persons over 23 years of age. In general, the current tariffs of the insurer apply. For all the bargain hunters: Don’t worry. The statutory insurance contributions for foreign students are the same for all health insurance companies. In comparison, BARMER covers many additional services not covered by other health insurance companies. And remember: with Fintiba Plus you will save up to € 95.00 on your travel health insurance.

Kickstart your journey to Germany!

Join our newsletter for essential tips to ensure a smooth relocation process.